Have you ever felt a little uneasy when you put money into something, wondering if it will all just disappear? It's a pretty common feeling, you know, especially when you are just starting out with investments or trying something new. People often talk about "hedging" in these situations, and it can sound like a rather complicated financial term. But what exactly does that mean, particularly when you're just dipping your toes into the investment waters, perhaps just dabbling a bit? This idea of hedging is actually about making things a little safer for your money.

So, too it's almost like building a little protective wall around your financial efforts. Think about it this way: when you plant a garden, you might put a fence around it, right? That fence helps keep out things that could harm your plants. In a very similar way, hedging in the world of money aims to reduce the chance of things going wrong, helping to keep your investments a bit more secure. It’s a concept that many people use, from big financial institutions to individuals just trying to manage their own personal savings, you know.

This article will help you get a better grip on what hedging means, particularly how it applies to your own financial ventures, even if you are just exploring. We'll look at why it matters and how it works to give you a bit more peace of mind. It’s not about avoiding all risk, but rather about being smart with the risks you take, which is a pretty good approach for anyone, really.

Table of Contents

- What is a Hedge, Really?

- Why Do People Hedge Their Money?

- How Does Hedging Work in Practice?

- Hedging and Your Dabbling Investments

- Frequently Asked Questions About Hedging

What is a Hedge, Really?

When you hear the word "hedge," your mind might first go to something green and leafy, like a boundary made of bushes. And you would be right, in a way! My text tells us that the meaning of hedge is "a fence or boundary formed by a dense row of shrubs or low trees." It also describes it as "a row of shrubs or small trees that are planted close to each other in order to form a boundary." This physical idea of a boundary or something that provides protection is actually very helpful for understanding its financial meaning, too.

The Garden Wall Analogy

So, just like those plants form a boundary, in finance, a hedge also forms a kind of boundary. It's "something that provides protection or defense usually + against" something else. Imagine you have a garden, and you put a hedge around it. That hedge helps keep out unwanted guests or strong winds, right? It's a protective measure, and that's exactly what a financial hedge aims to be. It's a very simple idea when you think about it that way, you know.

A Financial Safety Net

In the world of money, "a hedge is an investing strategy that aims to reduce risk by taking an opposite position in a related asset." This means it’s a plan, a way of doing things, that tries to lessen the chance of losing money. It's not about stopping all losses, but about making them less likely or less severe. It's a bit like having a safety net when you are walking a tightrope, you know, just in case things wobble a little.

This strategy is about being smart with your money, about thinking ahead. It's "an investment to reduce the risk of adverse price movements in an asset." So, if you own something, and you're worried its value might go down, a hedge is a step you take to try and soften that blow. It's a really practical way to approach the ups and downs of money matters, actually.

Why Do People Hedge Their Money?

People use hedging because they want to feel more secure about their money. No one likes the idea of their investments losing a lot of value, do they? My text points out that "hedging is the balance that supports any type of investment." This means it helps bring a sense of steadiness, a bit of equilibrium, to your financial ventures. It's about finding that sweet spot where you can still grow your money, but with less worry about sudden drops, you know.

Countering Losses

One main reason for hedging is to "counter losses in your core investments." Think of it like this: if you have a main investment that might go down in value, a hedge acts as a sort of counterweight. It's designed to move in a different way, so if your main investment dips, the hedge might go up, or at least not go down as much. This helps to soften the overall impact on your money. It's a pretty clever way to manage things, in some respects.

It's about having a backup plan, really. "A hedge offsets risk by adding an asset to your portfolio that moves differently than your core investments." This difference in movement is key. You're not just buying more of the same thing; you're buying something that reacts differently to market changes. This diversity helps to protect your overall financial picture, which is a good thing for anyone, you know.

Managing Uncertainty

The financial world can be a bit unpredictable, can't it? Prices can go up and down without much warning. Hedging is a way to deal with this uncertainty. It's "a strategy intended to protect an investment or portfolio against loss." It's about being prepared for those unexpected shifts. This doesn't mean you avoid all risk, but it means you're taking steps to manage the risks you face. It's a very sensible approach, especially when things feel a little shaky.

It helps you sleep a bit better at night, honestly. Knowing you have some protection in place can really ease your mind. It’s about being proactive rather than just reacting to whatever the market throws at you. This kind of thoughtful planning is what hedging brings to the table, and it’s something anyone can consider, even if they are just getting started, you know.

How Does Hedging Work in Practice?

So, how does this protective financial fence actually get built? It’s not about planting bushes, obviously, but it does involve making specific financial moves. My text explains some of the common ways this happens. It's all about how different parts of your money plan interact with each other. It’s a bit like setting up a complex machine where different gears work together, you know.

Taking an Opposite Stance

One key idea in hedging is "taking an offsetting position in a related security." This means if you own something that benefits when prices go up, you might also take a position in something else that benefits when prices go down. It's like betting on both sides of a coin flip, in a way, not to win big on one side, but to make sure you don't lose everything if the other side comes up. This balance is what helps to reduce the overall risk. It's a pretty common technique, actually.

My text also says that hedging "usually involves buying securities that move in the opposite direction than the asset being." This is crucial. You're looking for investments that tend to do well when your main investment is struggling, or vice-versa. This way, the ups and downs tend to cancel each other out a bit, leaving your overall financial position more stable. It's a smart move for anyone worried about market swings, you know.

Using Related Assets

The idea of "related assets" is important here. You wouldn't hedge a stock investment by buying a completely unrelated item like a car. The connection needs to be there for the hedge to be effective. For example, if you own shares in an oil company, you might hedge by buying something that benefits if oil prices fall. These are "related" in the sense that they both depend on the price of oil, but in opposite ways. It's about finding that connection, you see.

This careful selection of assets is what makes a hedge work. It's not just random buying; it's a thoughtful decision based on how different things tend to react to the same market forces. This helps to ensure that your protective measures are actually effective when you need them. It's a very practical aspect of managing your money, too.

Derivatives and Contracts

Sometimes, hedging involves specific financial tools called "derivatives." My text mentions, "A common form of hedging is a derivative or a contract whose value is measured by an underlying asset." These are like special agreements or contracts that get their value from something else, like a stock, a commodity, or an interest rate. They allow you to make a sort of side bet on how that underlying asset will move without actually owning the asset itself. It’s a bit like buying an insurance policy for your investments, you know.

These contracts are designed to move in a way that protects your main investment. For instance, if you own shares of a company, you might buy a derivative that gains value if those shares drop. This helps to offset any losses you might experience from your main shares. It's a sophisticated way to manage risk, but the core idea is still that protective boundary. These tools are used by many people, from large companies to smaller investors, honestly.

Hedging and Your Dabbling Investments

So, you might be thinking, "I'm just dabbling in investments, does this really apply to me?" And the answer is, yes, it absolutely can. Even if you're just taking small steps, the principles of protecting your money are still very much in play. "A hedge is an investment to reduce the risk of adverse price movements in an asset." This applies whether that asset is a huge portfolio or just a single stock you're trying out. It's about being smart with whatever you have, you know.

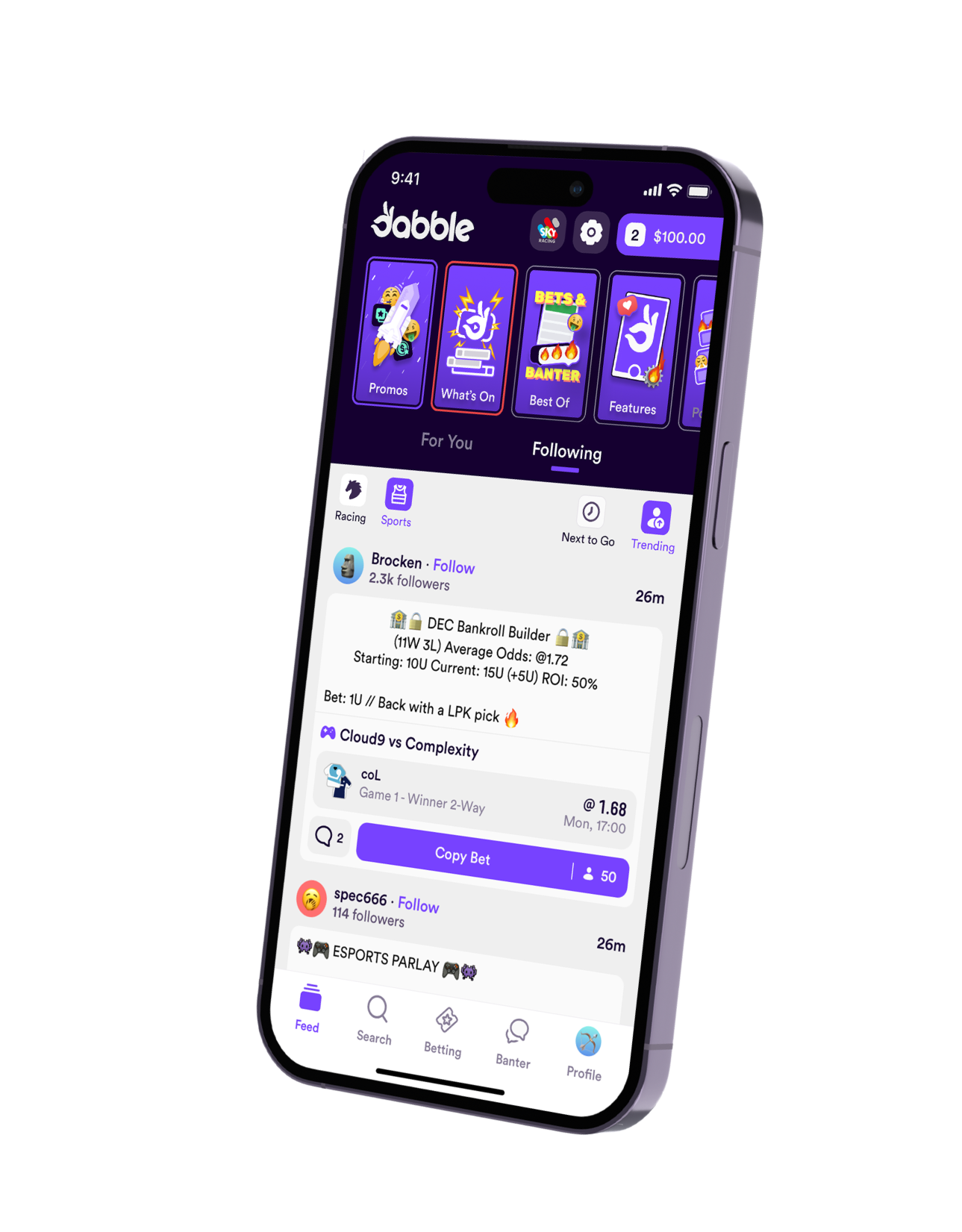

For someone who's just exploring the world of investments, understanding hedging means you're thinking about risk from the start. It helps you build a more resilient approach to your money, even if your amounts are small. It's like learning to put on your seatbelt even for a short drive; it's just a good habit to have. You can learn more about on our site, and link to this page for more insights.

While some hedging strategies can seem quite complex, the core idea is simple: don't put all your eggs in one basket, and have a plan for when things don't go exactly as you hoped. This mindset can save you a lot of worry and potential losses over time. It's about making your financial journey a bit smoother, which is something everyone wants, isn't it? You might even consider this a foundational piece of financial wisdom, actually.

Just as "many types of evergreen hedge shrubs create natural living privacy screens that block out" unwanted views, financial hedges aim to block out unwanted financial surprises. It's about creating a sense of security and stability around your money, no matter how much you're working with. It's a concept that truly supports a healthier relationship with your finances, today, and for the future, you know. To learn more about broader financial concepts, you can visit a reputable financial education site like Investopedia.

Frequently Asked Questions About Hedging

People often have questions when they first hear about hedging. Here are a few common ones that might be on your mind, too.

What's the simplest way to think about hedging?

The simplest way to think about hedging is like taking out an insurance policy for your investments. You pay a little bit, or take an opposite position, to protect against a bigger potential loss. It's about lessening the impact if things go wrong, just like car insurance helps if you have an accident, you know.

Does hedging mean I won't lose any money?

No, hedging does not mean you won't lose any money. It's about reducing or limiting your potential losses, not eliminating them entirely. There's always some risk when you put money into something, but hedging helps manage that risk, making it more predictable, you see.

Is hedging only for big investors or can I do it too?

While big investors and companies use complex hedging strategies, the basic idea of hedging is for everyone. Even simple things like diversifying your investments (not putting all your money in one place) or buying protective options can be forms of hedging that individual investors can use. It's about smart money management, regardless of how much you have, honestly.

Detail Author:

- Name : Janiya Schimmel

- Username : chet28

- Email : gutmann.leopold@yahoo.com

- Birthdate : 1988-12-02

- Address : 1499 Schoen Shoal East Fritz, OK 57428-6434

- Phone : 1-508-764-6669

- Company : Cartwright, Runte and Goyette

- Job : Occupational Therapist

- Bio : Ut sit distinctio quod praesentium aut debitis. Iusto nisi unde perspiciatis quae eveniet debitis quasi. Sunt exercitationem magni nesciunt et repellendus. Quia et aliquid vitae quas ut.

Socials

linkedin:

- url : https://linkedin.com/in/hudsonc

- username : hudsonc

- bio : Magnam aut nihil voluptatem non.

- followers : 961

- following : 2946

tiktok:

- url : https://tiktok.com/@hudson2022

- username : hudson2022

- bio : Aut neque odio eaque ea facere.

- followers : 2912

- following : 1952

instagram:

- url : https://instagram.com/hudsonc

- username : hudsonc

- bio : Officia tempore quis sed nisi. Facilis sapiente repellendus harum beatae.

- followers : 2546

- following : 2041