Have you ever wondered what exactly helps you get that new car or secure a spot for your business? It's not just about a good credit score, you know. There's this whole idea of "leasing power," which, frankly, is a pretty important piece of the financial puzzle. It tells lenders how much you can reasonably take on when you want to lease something, whether it's a vehicle, equipment, or even a commercial space. Understanding this concept can really change how you approach your next big financial step.

This idea of leasing power, it’s a bit like figuring out your personal financial strength for renting things instead of buying them outright. It’s about more than just having money in the bank; it considers your overall financial picture, helping a lender decide if you’re a good bet for a lease agreement. So, too it's almost, if you’re thinking about getting something through a lease, knowing what shapes this power is a really smart move.

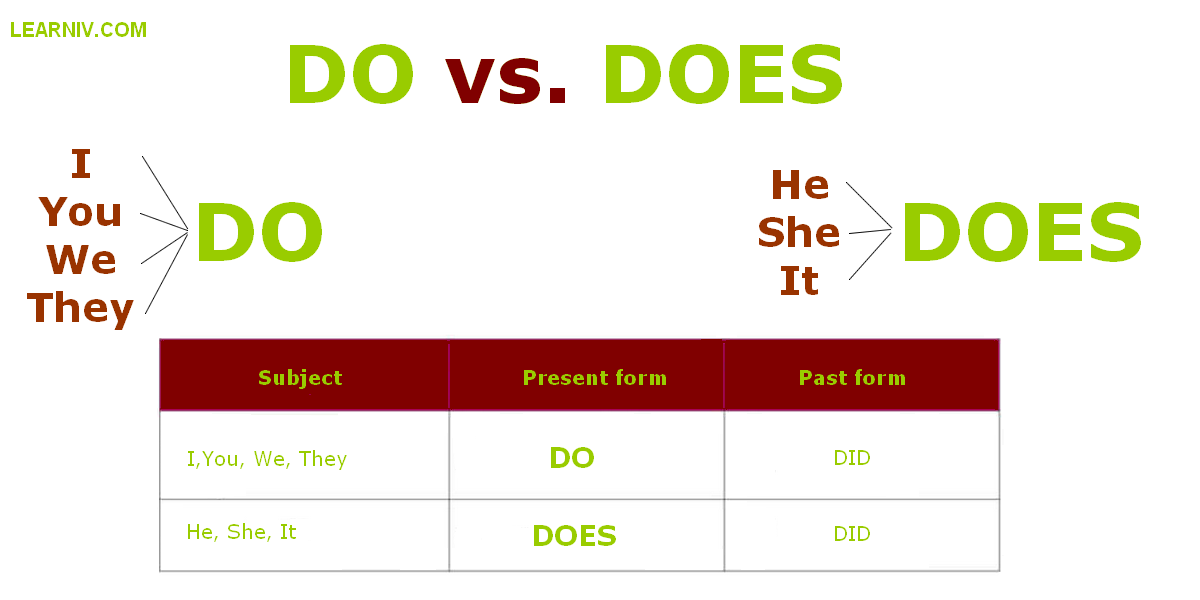

Just like knowing the exact use of words like "do" and "does" helps us speak clearly, as some folks point out, really getting what "leasing power" means makes your financial choices much clearer. It’s not a fancy, complicated term, but rather a practical way to look at your ability to manage lease payments. So, let's break it down and see what makes up this crucial financial measure.

Table of Contents

- What is Leasing Power, Actually?

- What Goes Into Your Leasing Power?

- Your Credit Health

- How Much You Earn

- Your Current Debts

- Things You Own

- Business Details (If You're a Company)

- How Lenders Figure It Out

- Tips to Boost Your Leasing Power

- Personal Leases Versus Business Leases

- Leasing Power and Your Bigger Financial Picture

- Frequently Asked Questions About Leasing Power

What is Leasing Power, Actually?

Leasing power, you see, is essentially a way for financial institutions to figure out how much lease obligation you can realistically take on. It’s their way of assessing your capacity to make regular payments for something you're renting for a set period. This isn't just about how much money you have right now; it’s a broader look at your financial stability and your ability to keep up with commitments over time. So, it's pretty important, especially if you're looking to acquire assets without a big upfront purchase.

Think of it like this: when you apply for a lease, the lender wants to be sure you won't struggle to pay them back. They're looking at your past behavior with money, your current income, and what you owe to others. This helps them determine your "power" to lease, which is a bit different from your overall credit score. It’s more focused on your payment potential for a specific kind of financial arrangement, you know?

This concept applies to a whole range of things, from getting a new car for personal use to a business needing specialized machinery or even a new office space. The core idea remains the same: it’s about your financial muscle to handle ongoing lease payments. Apparently, it’s a key factor for many people and businesses today.

What Goes Into Your Leasing Power?

When a lender looks at your leasing power, they're not just guessing. They consider several key pieces of information to build a full picture of your financial situation. Each part plays a role in showing whether you're a good fit for a lease agreement. Let's look at what typically influences this important measure.

Your Credit Health

Your credit history is, arguably, one of the most significant pieces of the puzzle. Lenders want to see if you have a good track record of paying bills on time and managing money responsibly. A strong credit history shows them that you’re dependable. This means looking at your credit score, but also the details of your past loans and credit cards. It’s about how well you've handled borrowing money in the past, basically.

If you've got a history of missed payments or high debt, it can make lenders a little hesitant. On the other hand, a long history of on-time payments and a sensible use of credit can really boost their confidence in you. So, keeping your credit in good shape is a pretty fundamental step for anyone considering a lease.

How Much You Earn

Your income is, naturally, another big part of the equation. Lenders need to see that you have a steady and sufficient income stream to cover the lease payments. They’ll typically look at your gross income, which is what you earn before taxes and other deductions. This gives them a clear idea of your earning potential. They want to know that after all your other regular expenses, there's still enough left over for the lease payment, you know?

This isn't just about your salary; it can include other reliable sources of income too, like income from a side business or investments. The more stable and consistent your earnings are, the better it looks to potential lessors. It’s a pretty straightforward calculation, in some respects.

Your Current Debts

What you already owe to others is also a really important consideration. Lenders look at your existing debt obligations, like mortgage payments, car loans, credit card balances, and student loans. They want to see your debt-to-income ratio, which compares how much you owe each month to how much you earn. A high amount of existing debt can, quite simply, reduce your leasing power because it suggests you might be stretched thin already.

If you have a lot of monthly payments going out, it leaves less room for new lease payments. So, managing your current debts well and trying to keep them at a reasonable level can make a big difference when you're looking to lease something. It's about showing you have financial breathing room, that.

Things You Own

Your assets, or the things you own that have value, can also play a role, especially for larger leases or for businesses. This could include savings accounts, investments, or even property. While not always the primary factor for every lease, having significant assets can show a lender that you have a financial cushion and are generally financially secure. This provides an extra layer of reassurance to them, you know?

For instance, if you have a good amount of savings, it tells the lender that even if something unexpected happens, you likely have resources to fall back on. This can subtly improve your perceived ability to handle lease obligations. It’s a bit like having a strong backup plan, really.

Business Details (If You're a Company)

For businesses, the assessment of leasing power takes on a slightly different shape. Lenders will look at the company's financial statements, including its revenue, profitability, and cash flow. They want to see that the business is healthy and generates enough money to comfortably cover the lease payments. This is a bit more complex than personal finances, as it involves looking at the entire operation. They might also look at how long the business has been around and its industry stability, for example.

The business's credit history is also very important, separate from the owner's personal credit. A strong business credit profile and a clear record of consistent income are absolutely key here. This helps ensure the business can meet its financial promises. So, for a company, it's about the health of the entire enterprise, basically.

How Lenders Figure It Out

When you apply for a lease, the lender doesn't just glance at your application and make a snap decision. They use a pretty structured process to figure out your leasing power. First, they pull your credit report and score, which gives them a quick snapshot of your credit habits. They'll also ask for proof of income, like pay stubs or tax returns, to verify your earnings. For businesses, they’ll request financial statements and possibly even business plans. It's a thorough look, you know?

They then use all this information to calculate various financial ratios, such as your debt-to-income ratio, which we talked about earlier. They compare these ratios against their own internal guidelines to see if you fit their risk profile. Each lender has slightly different criteria, so what one lender might approve, another might not. It’s not an exact science across the board, but rather a set of guidelines. They're trying to predict your ability to pay, in a way.

Sometimes, they might even look at the specific item you want to lease. For instance, a very expensive piece of equipment might require a stronger financial standing than a basic office printer. It’s all about balancing the risk with the potential reward for them. So, understanding their perspective can really help you prepare your application.

Tips to Boost Your Leasing Power

If you're looking to increase your ability to lease, there are several practical steps you can take. These aren't overnight fixes, but rather sensible financial habits that build over time. Improving your leasing power means making yourself a more attractive candidate to lenders, basically.

- Pay Your Bills Promptly: This is probably the most direct way to improve your credit history. Consistently paying all your bills on time shows responsibility and reliability. This includes credit cards, loans, and even utility bills. It's a pretty big deal, you know?

- Reduce Your Existing Debts: Lowering your overall debt load, especially high-interest credit card debt, can significantly improve your debt-to-income ratio. This frees up more of your income for new lease payments. So, paying down those balances is a very smart move.

- Check Your Credit Report: Get a copy of your credit report regularly and check for any errors. Mistakes can unfairly lower your score, and fixing them can quickly give your leasing power a boost. It’s good to be proactive about this, you know?

- Increase Your Income (If Possible): While not always easy, finding ways to increase your steady income can directly improve your ability to take on more financial commitments. This could be through a raise, a side gig, or even optimizing investments. It’s a pretty direct way to show more financial capacity.

- Build Up Savings: Having a healthy savings account provides a financial cushion and signals to lenders that you are financially prudent. This can be particularly helpful for larger leases. It shows you have resources, you see.

- For Businesses, Strengthen Financials: Companies should focus on improving profitability, managing cash flow effectively, and maintaining a strong balance sheet. Demonstrating consistent growth and stability is key for business leasing power. This means keeping a close eye on the books, basically.

Taking these steps can really put you in a better position when you're ready to lease. It's about showing financial discipline and reliability, you know?

Personal Leases Versus Business Leases

It's important to know that while the core idea of leasing power remains similar, how it's assessed differs quite a bit depending on whether it's for a person or a business. For individuals, the focus is heavily on personal credit scores, individual income, and personal debt. Lenders want to see your personal financial habits. So, your past spending and payment behavior are really key here.

For businesses, the assessment is much more about the company's financial health. Lenders will look at the business's revenue, its profits, its cash flow, and its specific business credit score. They'll want to see if the company itself is stable and generates enough money to cover the lease. Sometimes, a personal guarantee from the business owner might also be required, especially for newer or smaller businesses, which means your personal finances still play a role. But, typically, it’s the business’s performance that takes center stage.

The type of asset being leased also plays a part. A personal car lease is pretty straightforward, but leasing heavy machinery for a factory involves a much deeper look into the business's operational and financial capabilities. So, the context really changes the evaluation process, you know?

Leasing Power and Your Bigger Financial Picture

Understanding your leasing power isn't just about getting approved for a lease today; it's actually a pretty good indicator of your overall financial health. When you know what factors influence your ability to lease, you gain insights into areas where you might need to improve your financial habits. It’s a bit like a financial check-up, in a way.

For instance, if your leasing power is low because of high debt, it signals that perhaps you should focus on debt reduction. If it's due to a shaky credit history, then working on consistent payments becomes a priority. It helps you make more informed decisions about your financial future, not just about leasing. So, it's really a tool for broader financial awareness, you know?

Thinking about your leasing power helps you make choices that align with your long-term financial goals. It encourages responsible borrowing and planning, which are good habits for anyone. It's about building a solid financial foundation, which, apparently, benefits you in many aspects of life. Learn more about financial planning on our site, and link to this page understanding credit scores for more insights.

Frequently Asked Questions About Leasing Power

Here are some common questions people often ask about leasing power:

What is the difference between leasing power and credit score?

Your credit score is a numerical representation of your creditworthiness, basically a summary of your credit history. Leasing power, on the other hand, is a broader assessment by a lender that uses your credit score, but also considers your income, existing debts, and assets to determine how much you can comfortably afford to lease. So, your credit score is one piece of the puzzle, but leasing power looks at the whole picture, you know?

Can I improve my leasing power quickly?

Some aspects of improving your leasing power, like paying down a credit card balance, can have a relatively quick impact. However, significant improvements, such as building a long and positive credit history or substantially increasing your income, typically take more time. It’s usually a gradual process, you know? There are no real shortcuts for lasting improvement, basically.

Does leasing power apply to personal leases or just business?

Leasing power applies to both personal and business leases. The underlying principle is the same: assessing your ability to make regular payments. The factors considered might differ slightly, focusing on personal finances for individuals and business financials for companies, but the concept is relevant for both types of lease agreements. So, it’s a pretty universal idea, really.

For more general information on financial terms, you might find resources from reputable financial education sites helpful, for example, a quick search for consumer finance tips could be a good starting point.

Detail Author:

- Name : Jessyca Mraz

- Username : gottlieb.ethan

- Email : considine.jacquelyn@wilkinson.com

- Birthdate : 1987-05-27

- Address : 44020 Haley Point Suite 307 Janicefurt, IN 32395-9825

- Phone : +1-478-514-1754

- Company : Grady-Ledner

- Job : Cooling and Freezing Equipment Operator

- Bio : Itaque vel sint molestiae soluta. Iste ex illo ex rerum id. Consequuntur voluptas atque quas et. Quibusdam tenetur ut id fuga.

Socials

tiktok:

- url : https://tiktok.com/@kadams

- username : kadams

- bio : Commodi nostrum quibusdam deleniti officiis distinctio.

- followers : 5756

- following : 460

twitter:

- url : https://twitter.com/katelynn1927

- username : katelynn1927

- bio : Veritatis rerum quam voluptas sed ut nam ut fugit. Nihil repellat expedita adipisci veniam. Provident officia nobis dolorum dicta autem impedit illum minima.

- followers : 1167

- following : 2327

instagram:

- url : https://instagram.com/adamsk

- username : adamsk

- bio : Veniam id optio facilis quam. Enim eum eos dolorem. Omnis reprehenderit consectetur illum adipisci.

- followers : 6946

- following : 487