Imagine a place where money management feels almost effortless, where every financial move is backed by truly intelligent insights. That, in a way, is the promise of a truly smart financial center, and specifically, we're going to talk about what makes a particular area, like smart financial center section 103, stand out. This isn't just about buildings; it's about a whole new way of handling wealth, fostering growth, and connecting people with their financial goals in a super modern setting. It's a concept that's gaining a lot of interest, and for good reason, too.

When we talk about "smart" in this context, it's a bit like thinking about how a "smart casual" outfit combines comfort with a polished look, as mentioned in some definitions. It’s about blending advanced technology with a very human-centric approach. This means using clever systems to make financial processes smoother, safer, and more accessible for everyone involved. It’s a pretty exciting prospect, honestly, for anyone looking to stay ahead in their financial planning or business operations. You know, it’s about making things work better.

The idea behind these centers is to create an environment where financial services aren't just available, but they're also optimized for performance and ease of use. Think about how a good router optimizes its "Smart Connect" feature for the best performance; a smart financial center does something similar for your money. It’s about getting rid of those frustrating moments, like when software won't connect to the internet, and instead, building systems that just work, reliably, every time. So, let's explore what makes a spot like section 103 a true gem.

Table of Contents

- What Defines a Smart Financial Center?

- Why Smart Financial Center Section 103 is a Key Spot

- Benefits for Individuals and Businesses

- Looking Ahead: The Impact of Smart Financial Centers

- Frequently Asked Questions About Smart Financial Centers

What Defines a Smart Financial Center?

A smart financial center, at its heart, is a place that uses cutting-edge technology to make financial activities more efficient, more secure, and more responsive to people's needs. It’s not just about having the latest gadgets, but about how those gadgets work together to create a truly integrated experience. You know, it's about the synergy.

The Core of Smartness: Technology Integration

One of the biggest parts of a smart financial center is how it brings together various technologies. Think about how a computer's GPU acceleration can dramatically boost performance, sometimes by as much as 50%; a smart financial center applies this kind of thinking to its entire infrastructure. This means using advanced data analytics, artificial intelligence, and blockchain technology to process transactions, manage risks, and offer personalized financial advice. It’s about creating a seamless flow of information, almost like a well-oiled machine, where everything just clicks into place. This approach helps avoid those frustrating moments where systems just freeze up, like a hard drive showing bad "SMART info" and refusing to budge.

Furthermore, these centers often use sophisticated software systems, much like how a ThinkPad manages its various "Smart Mark" or "Access Connections" programs. They have to decide what's essential to keep and what can be safely removed, ensuring the core operations run smoothly without unnecessary clutter. This careful management of digital tools is, in a way, what allows for truly robust financial operations, making sure everything is always connected and working as it should be. It's a pretty big deal, actually.

Human-Centric Design and Accessibility

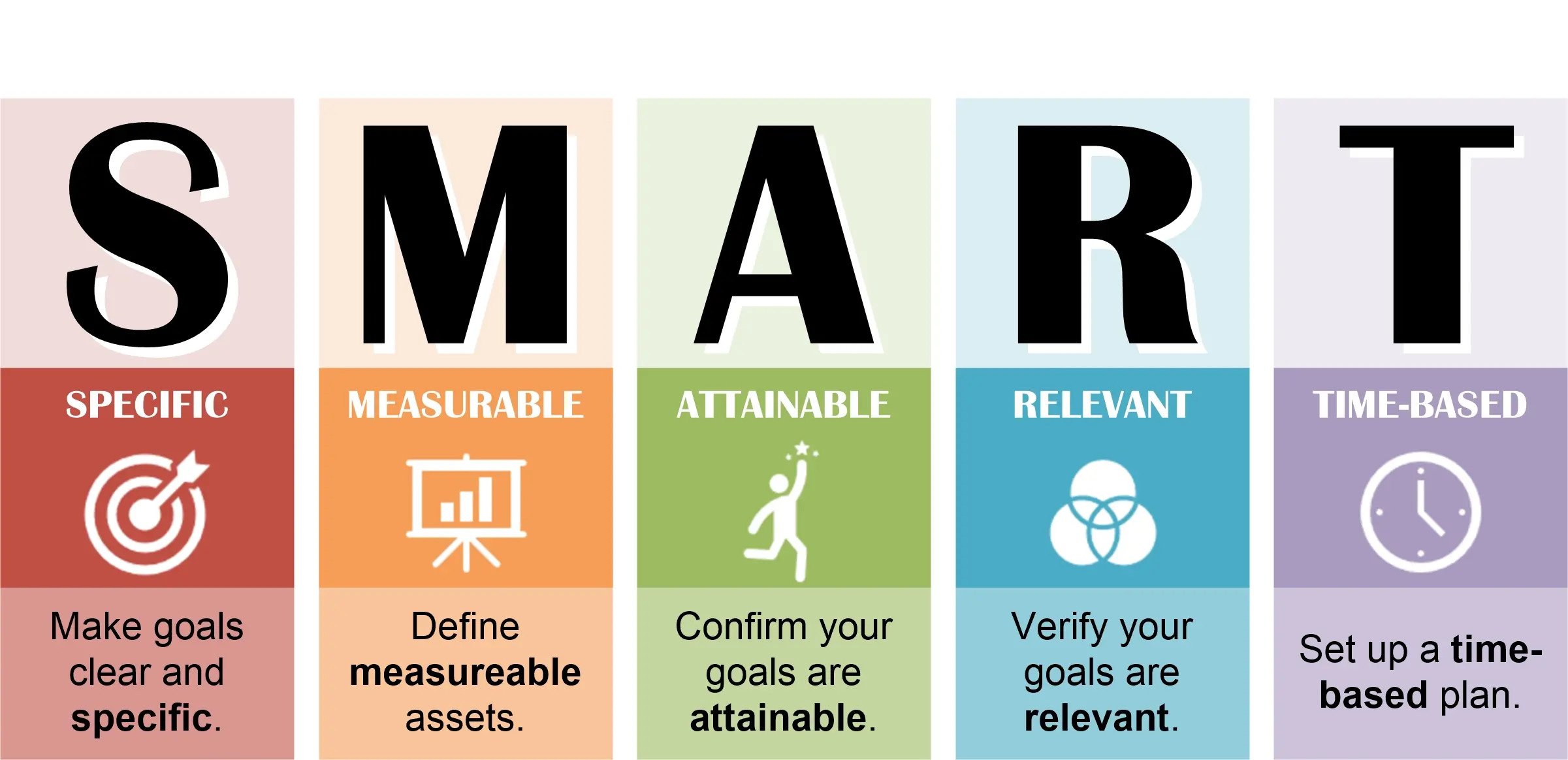

While technology is a big part, a smart financial center also focuses heavily on the people who use it. This means designing spaces and services that are easy to use, intuitive, and welcoming. It’s about making complex financial matters feel approachable, rather than intimidating. For instance, the "SMART principles" – Specific, Measurable, Achievable, Relevant, Time-bound – which some say Peter Drucker first talked about, aren't just for goal setting; they can also guide how financial services are structured, making them clearer and more effective for the user. This focus ensures that the center isn't just technologically advanced but also genuinely helpful and easy to interact with for everyone, from seasoned investors to first-time savers. It's about making finance more human, if that makes sense.

Accessibility is another important piece, too. A truly smart center aims to make its services available to a wide range of people, using various platforms and interfaces. This might involve intuitive digital tools, personalized support, and even physical spaces that encourage collaboration and learning. It’s about ensuring that financial well-being is within reach for more individuals and businesses, creating a truly inclusive environment where everyone feels comfortable seeking advice or making transactions. This means less confusion and more clarity, which is something we all appreciate, honestly.

Sustainability and Future Readiness

A smart financial center isn't just about today; it's very much about tomorrow. This means incorporating sustainable practices, from energy-efficient building designs to eco-friendly operational procedures. It’s also about being adaptable, ready to embrace new technologies and shifts in the global economy. Think about how car manufacturers like smart are looking at electric vehicles with long ranges; a smart financial center has that same forward-thinking approach, always evolving its core capabilities for the long haul. This kind of foresight helps the center remain relevant and effective for years to come, providing stability in a constantly shifting financial world. It’s about building something that lasts, you know?

Furthermore, being "future-ready" also involves a commitment to ongoing innovation. This means constantly evaluating new financial technologies and methodologies, much like how different laser eye surgeries like "SMART All-Laser" continue to refine their approaches. A smart financial center is always looking for ways to improve its services, enhance security, and provide even greater value to its users. It’s a dynamic place, always learning and adapting, which is, quite frankly, what you want in a financial hub. So, it's pretty exciting.

Why Smart Financial Center Section 103 is a Key Spot

Now, let's zoom in on why a specific area, like smart financial center section 103, might be particularly noteworthy. While all smart financial centers share common characteristics, certain sections or zones within them can develop unique advantages, making them especially attractive for particular types of financial activity or businesses. It’s almost like a specialized district within a larger, clever city.

Strategic Location and Connectivity

Often, a specific section like 103 gains prominence due to its strategic position. This might mean exceptional physical connectivity, like easy access to transportation hubs, or superior digital connectivity, with ultra-fast internet infrastructure. This is similar to how a good router's "Smart Connect" feature optimizes for the best signal; section 103 could be optimized for the fastest financial data flow. This kind of prime location makes it incredibly appealing for businesses that rely on rapid communication and quick decision-making, like high-frequency trading firms or international investment groups. It really does make a difference, you know, when every second counts.

The ability to connect seamlessly, both physically and digitally, can be a major draw. Think about how important it is for software to just connect to the internet without issues; section 103 would prioritize this kind of robust, always-on connectivity. This ensures that businesses operating there experience minimal downtime and maximum efficiency, allowing them to focus on their core financial activities rather than troubleshooting technical glitches. It's about creating an environment where everything just works, pretty much all the time.

Tailored Solutions for Diverse Needs

Another reason smart financial center section 103 might stand out is its ability to offer very specific, tailored solutions. This could mean it has particular expertise in certain financial sectors, like fintech startups, sustainable finance, or wealth management for high-net-worth individuals. It’s a bit like how different "SMART principles" can be adapted for various situations; section 103 might have refined its services to meet very precise market demands. This specialization makes it a magnet for businesses and individuals seeking highly customized financial services and a supportive ecosystem for their particular niche. It’s not a one-size-fits-all approach, which is often what people are looking for, honestly.

This customization might extend to regulatory frameworks, talent pools, or even specialized technological infrastructure that supports specific financial innovations. It's about providing an environment where unique financial ventures can truly flourish, offering the right tools and connections for success. This kind of focused support can be incredibly valuable, especially for newer companies looking to make their mark. So, it's quite a compelling proposition.

A Focus on Data Integrity and Security

In any financial setting, data integrity and security are paramount. Smart financial center section 103 would place an extremely high priority on protecting sensitive financial information. This involves using advanced encryption, robust cybersecurity measures, and continuous system monitoring. It’s similar to how SSDs have "SMART info" to monitor their health; a smart financial center constantly checks its own systems for any anomalies or potential issues, ensuring everything is running smoothly and securely. This proactive approach helps prevent data breaches and system failures, providing peace of mind for everyone involved. It's really about trust, isn't it?

Moreover, the center would have clear protocols for managing and recovering data, even in the face of unexpected issues. Think about how a hard drive might suddenly show bad "SMART info" and become unusable; a smart financial center would have redundant systems and recovery plans to prevent such catastrophic data loss. This dedication to data resilience is a critical component of its "smartness," ensuring that financial operations remain uninterrupted and secure, no matter what. This level of care is, quite frankly, what you expect from a top-tier financial hub.

Benefits for Individuals and Businesses

The advantages of engaging with a smart financial center, and particularly a standout section like 103, are pretty broad, impacting both individual consumers and large corporations. It’s about making financial life simpler, safer, and more productive for everyone. You know, it's about making things better.

Streamlined Operations and Efficiency

For businesses, operating within a smart financial center means significantly streamlined operations. Automated processes, real-time data access, and integrated platforms can cut down on administrative burdens and boost overall efficiency. It's like having a dedicated "power manager" for your entire financial ecosystem, ensuring everything runs at optimal performance without wasting resources. This allows companies to focus more on strategic growth and less on day-to-day logistical hurdles, freeing up valuable time and personnel. This can lead to pretty significant savings and increased output, which is always good, right?

Individuals, too, benefit from this efficiency. Managing investments, paying bills, or seeking financial advice becomes much easier through intuitive digital interfaces and responsive support systems. The goal is to eliminate friction points, making financial tasks less of a chore and more of a straightforward process. This kind of ease of use can genuinely improve a person's financial well-being, reducing stress and helping them stay on top of their money matters. It's about making finance feel less complicated, honestly.

Enhanced Decision-Making with Smart Insights

One of the most compelling benefits is the access to truly intelligent insights. Smart financial centers use advanced analytics to provide users with data-driven recommendations and forecasts. This is where the "SMART principles" really shine, helping to make financial decisions more Specific, Measurable, Achievable, Relevant, and Time-bound. Whether it's identifying investment opportunities, managing risk, or planning for retirement, these insights empower individuals and businesses to make more informed choices. It's about having a clearer picture of your financial landscape, allowing you to move forward with greater confidence. This kind of guidance is, in a way, invaluable.

For businesses, this means better market intelligence and competitive advantages. For individuals, it translates into personalized financial advice that genuinely reflects their unique circumstances and goals. It’s about moving beyond guesswork and relying on robust data to guide your financial journey. This level of informed decision-making can lead to much better outcomes over time, helping people achieve their financial aspirations more effectively. So, it's a very powerful tool.

A Community of Innovation

A smart financial center, especially a vibrant section like 103, often fosters a thriving community of innovation. It brings together financial experts, technology developers, entrepreneurs, and investors, creating a dynamic environment for collaboration and new ideas. This is where fresh perspectives meet cutting-edge technology, leading to the development of new financial products and services. It’s a place where the next big thing in finance might just be born, offering unique opportunities for networking and growth. You know, it's a bit like a hub for new ideas, constantly buzzing with activity.

This collaborative spirit benefits everyone. Businesses can find partners, talent, and funding more easily, while individuals might gain access to groundbreaking financial solutions before they become mainstream. It’s about being part of an ecosystem that constantly pushes the boundaries of what's possible in finance, ensuring that participants are always at the forefront of the industry. This kind of environment is, quite frankly, pretty exciting to be a part of. Learn more about smart city initiatives on our site, and link to this page for deeper insights into financial technology.

Looking Ahead: The Impact of Smart Financial Centers

The development of smart financial centers, and the specialization of areas like section 103, represents a significant step forward in how we interact with money and financial services. They are designed to be resilient, adaptable, and constantly evolving, much like a living organism. This ongoing evolution means they will continue to integrate the latest technological advancements, ensuring they remain at the forefront of the global financial landscape. It’s a very dynamic process, constantly improving.

As these centers mature, they are likely to play an even more crucial role in driving economic growth and fostering financial inclusion on a global scale. They offer a blueprint for how finance can be made more accessible, transparent, and efficient for everyone, from large corporations to individual savers. The focus on sustainability also means they are building a financial future that is not only prosperous but also responsible. It's a pretty hopeful vision, honestly, for how things could be.

The continuous optimization of these centers, much like how a router's "Smart Connect" feature is specifically optimized for each model, means that their services will only become more refined and effective over time. They are, in a way, always learning and adapting to the needs of their users and the broader financial environment. This commitment to improvement ensures that smart financial centers, and their key sections like 103, will remain vital hubs for innovation and progress in the years to come. So, it's quite a compelling direction for finance.

Frequently Asked Questions About Smart Financial Centers

People often have questions about these modern financial hubs. Here are a few common ones:

What kind of technology powers a smart financial center?

A smart financial center uses a whole range of advanced technologies, honestly. This includes things like artificial intelligence for analyzing data and making predictions, blockchain for secure and transparent transactions, and high-speed computing infrastructure, sometimes even with GPU acceleration, for processing huge amounts of information very quickly. It's about integrating these different tools to create a seamless and efficient financial environment. They also have sophisticated network systems, a bit like how a router uses "Smart Connect" to optimize its performance, ensuring reliable connections.

How do smart financial centers ensure the security of my financial data?

Security is a top priority, really. These centers use multiple layers of protection, including strong encryption, advanced cybersecurity protocols, and continuous monitoring of their systems. They often have robust data backup and recovery plans in place, too, to protect against any issues, much like how "SMART info" helps monitor the health of a hard drive. The idea is to create a very secure digital environment where your financial information is well-protected from threats. It's about building trust, you know?

Can individuals benefit from smart financial centers, or are they just for big businesses?

Absolutely, individuals can benefit a lot, honestly! While big businesses certainly gain from the advanced infrastructure and services, smart financial centers are also designed to offer more intuitive and accessible financial tools for everyday people. This can mean easier access to personalized financial advice, streamlined banking processes, and better ways to manage investments. It’s about making financial management simpler and more effective for everyone, not just corporations. So, it's pretty inclusive.

For more general information on smart city concepts and how they integrate financial services, you might find this resource helpful: The World Bank's Smart Cities Overview.

Detail Author:

- Name : Elmo Anderson

- Username : rosenbaum.sandra

- Email : carolyn04@homenick.com

- Birthdate : 1976-02-29

- Address : 9660 Greenholt Trafficway New Guillermoborough, AK 80408

- Phone : +1-980-255-2611

- Company : Lang Group

- Job : Alteration Tailor

- Bio : Esse pariatur ea facilis ex et. Ex ut molestias aperiam eaque praesentium. Non quos possimus at praesentium. Laborum eligendi aut sit harum accusamus itaque. Dolore dolor illo quis aut et architecto.

Socials

linkedin:

- url : https://linkedin.com/in/kaya_olson

- username : kaya_olson

- bio : Illo quia deleniti autem repudiandae.

- followers : 6188

- following : 672

tiktok:

- url : https://tiktok.com/@olsonk

- username : olsonk

- bio : Et iure totam deserunt amet eos fugit. Molestiae aut ad dolor aspernatur.

- followers : 4885

- following : 1001

instagram:

- url : https://instagram.com/kaya_olson

- username : kaya_olson

- bio : Enim voluptatibus in placeat magnam incidunt vero. Laborum optio ducimus incidunt.

- followers : 251

- following : 2915